Water as a Commodity

Why Trade Water

The UN and the World Bank, as well as virtually every other major international body involved in global economics, has become acutely aware that the supply of fresh water is limited while global demand is ever on the increase. Not only this, but the governments and landowners responsible for stores of fresh water have traditionally opted to invest in industries that underestimate the importance of this vital resource.

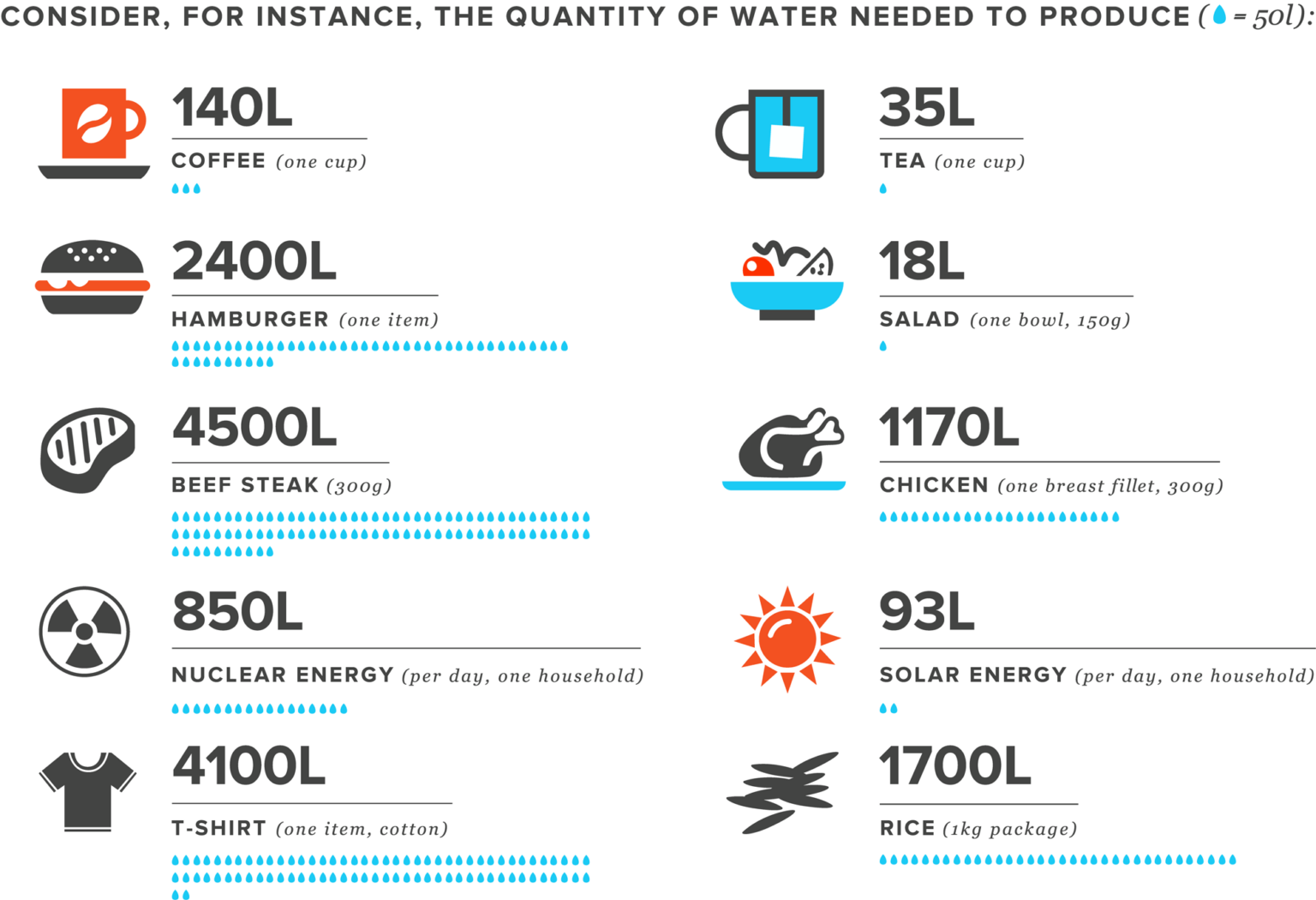

Water is squandered in production processes, even those as simple as the manufacturing of T-shirts, because a definite value is not attributed to it.

The only truly effective method of protecting the supplies we have is to turn water into a financial asset.

The fiscal benefits include the use of fresh water as recognised collateral. This means that states or anyone in possession of large quantities of fresh water can now ascribe a value to their asset and use it against loans.

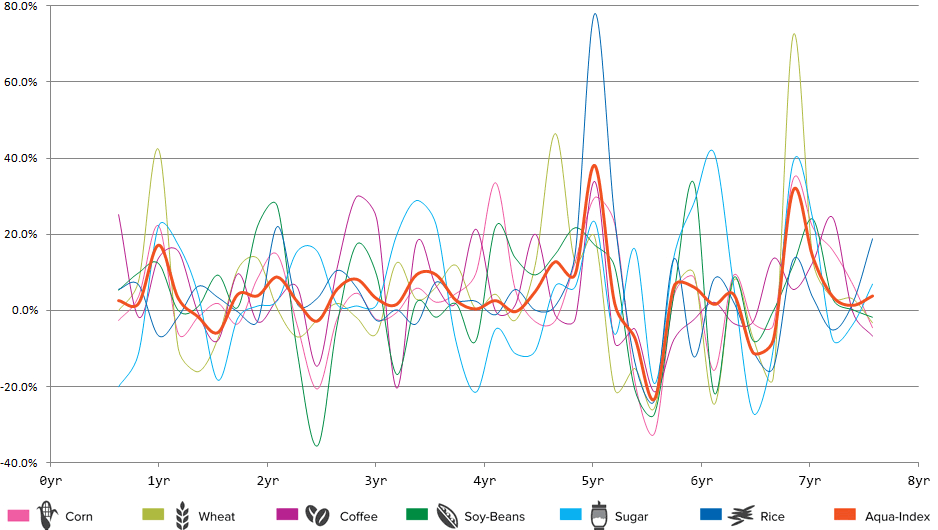

Financial institutions wishing to invest in commodities (or hedge against inflation) will be able to add water to their portfolio. In addition they will be able to invest in an asset that is ultimately more stable than specific commodity markets by looking at water not only as a commodity in its own right but as a denominator representative of all agricultural stock – a commodity index.

Water is the new ‘blue’ gold!

AQUA INDEX makes all this possible.

The Aqua Index

The AQUA INDEX proprietary algorithms use, among other factors, the amounts of water known to be required in the production of various commodities to extract a price for water.

AQUA INDEX’s patents give it exclusive rights in the use of a mathematical formula using available market data as factors in the equation.

This results in an ‘index’ for water that is derived from and is representative of the major agricultural commodities, creating a more stable instrument, as can be seen below.

Commodity Exchanges

Fresh water is recognised as a commodity by the EU and is subject to both an increasing demand and a limited supply.

It is subject to a wide range of prices, tax rates, exit fees and other regulations.

AQUA INDEX provides the first ever platform for the creation of a market for stable investment in water, enabling development of indices, futures and other derivatives.

AQUA INDEX estimates that trade in water may represent 10% of the daily turnover in agricultural commodities, or $4.5bn per day.

Water as an asset, and therefore collateral, may be used as security for financing of any sort, creating capital that hitherto was unrecognised.

The world’s commodity exchanges, such as the Chicago Mercantile Exchange (CME) and the London Commodity Exchange (LCE – now part of LIFFE), have yet to trade securities or derivatives on water.

AQUA INDEX will introduce trade in water as certificates, futures, options and other derivatives to the international financial markets.

Aqua-Index Exchange

Aqua-Index Exchange (AIX) is a US based corporation registered in Illinois.

In addition to having presented its first 2 indices on the Bloomberg terminal, it has filed its application with the U.S. Commodity Futures Trading Commission (CFTC) to become a Designated Contract Market (an electronic futures/options exchange).

AIX is a derivatives marketplace strongly committed to the development and implementation of standardizing the pricing of water thereby providing the vehicles for trading of water-based instruments on international commodities or derivatives exchanges. The Company intends to facilitate the use of water as a financial asset.

AIX’s products are an attempt to standardize the way water and financial instruments based on water are traded by providing a standard, impartial pricing method based on the Aqua-Index patented algorithmic pricing model. They are directed at free trade in a free market for water and instruments based on water.

There is a growing demand for ecological solutions which minimize the carbon footprint. While the need for and use of water is universal, water prices vary from locale to locale and country to country, and in quality and type. A standard price for fresh water may be achieved through the public trading of water-based instruments on international commodities or derivatives exchanges.

The Company’s business strategy is to launch a new exchange to promote and market trading of futures or and options on futures contracts based upon the Company’s proprietary price transparent water index.

Aqua Exchange

Aqua Exchange is an electronic water trading market with new financial instruments based on water. These are in the form of asset-backed tokens representing the ownership of water.

Aqua Exchange is a cryptographic exchange to allow encrypted balances and transactions and establish a global tradable water market.

Aqua Exchange offers an array of financial instruments under the following categories and others:

WATERCOIN™ – tokenized water assets based on water sources in English-speaking countries utilizing the Aqua Index pricing methods.

AQUACOIN™ – tokenized water assets based on water sources in countries where English is not the primary language, utilizing the Aqua Index pricing methods.

WATERFOREX™ – water-centric indexes based on commodity prices sourced in North American territories that are traded on the Exchange.

AQUAFOREX™ – water-centric indexes based on commodity prices sourced in territories outside of North America that are traded on the Exchange.

Our index prices are published on Bloomberg and The Wall Street Journal. For further information please be in touch via the Contact Us page.